Some Of Writing Your Will

Numerous are unaware that if you do not have an estate plan, your estate should go through court of probate, rapidly draining the hard-earned money you desired your heirs to acquire. Probate Courts need monthly filings with charges, hearings with court expenses, and much more if an individual gets in the probate case to contest your will.

Additionally, a Judge will have authority over any circulation of your assets and to whom. Each state has its own set of probate laws, and lots of are extremely old however have never ever been upgraded. Working with an estate preparation attorney can safeguard your properties and financial investments from becoming nickeled and dimed by the old-fashioned process of probating wills and estates in a court of law. Establishing an estate plan keeps your estate out of the courts and where you desire them.

Estate planning is complicated and includes ever-changing laws and tax regulations. You need an attorney's proficiency in both the locations of law and tax. As a matter of truth, most estate planning lawyers likewise hold a Certified Public Accountant (Qualified Public Accountant) license and can save you Certified Public Accountant fees by doing the tasks and research study required in a structured estate strategy. It's not recommended to use forms and design templates offered on the market as they can't deal with these changes or discuss your alternatives with you.

Planning Your Estate Through an Attorney

Finding an outstanding lawyer is a financial investment in your beneficiaries' future. Trust documents is consisted of a number of basic legal files tailored to set out your dreams as to who, when, and how your cash will go to each beneficiary or entity.

Developing Your Trust Files

Your trust will be your most important document to which your other estate planning files will support. Your estate planning attorney will talk about with your choices with you. In a trust file, the sky is the limit-- nearly.

Some Trusts consist of directions on who and how a deceased family pet will be taken care of and to which veterinarian is to care for him or her. The trust will authorize individuals of your selecting to act upon your behalf or co-trustees to act upon your behalf together.

You can empower one private to manage the investment, sale, compensations, and the like, while licensing a various person or individuals to process your directions on circulation of assets, such as your home and possessions, which you will set out in a separate document in your trust documents; your last will and testimony.

Last Will and Testament

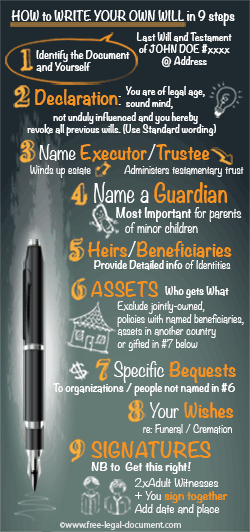

The last will and testament in your trust paperwork resembles any other will, but it describes the direction contained in the language of the trust. It includes all the basic bequeaths, sets out who you designate as your personal agent, and your asked for way of burial, as in any will. Any last will and testament can be changed or withdrawed need to you wish while you are living.

Long Lasting Power of Attorney and Healthcare Proxy

Successfully developing your resilient power of attorney and medical long lasting power of attorney are vital aspects of your estate strategy. Need to you end up being legally disabled, you'll want a trusted person to be lawfully able to make choices in your place.

The durable power of attorney document licenses who you picked as your trustee, or co-trustees, to make choices as if they were you upon your incapacitation or death. Your healthcare proxy, or wills and trusts attorneys advance instruction as it is often described as, is the legal document setting out your desires concerning your medical treatment, especially whether you want continued life-sustaining nutrients in case of coma or other conditions where you are incapable of voicing your wishes. These 2 documents are likewise amendable and revocable while you are still living and meaningful.

Tax Consequences

Failure to correctly plan your estate can lead to significant tax and charges associated with bring out your fundamental wishes. A qualified lawyer understands the ins and outs of tax law, and they can encourage you ways to minimize tax on your trust earnings, possessions, and asset transfers. In one year, tax law floorings and ceilings changed from $600,000 to $10 million.

Considering that any document in your Estate Preparation Packet can be changed or revoked, it is crucial you meet your estate planning lawyer occasionally to guarantee your files reflect your current wishes and estate.

Conclusion

An estate preparation lawyer is an important factor when it comes to creating an ironclad estate plan. They are experts that work to guarantee that the language in your documents show your desires and protect those wishes. Make certain to do some major research before choosing on an estate planning lawyer you can rely on. It deserves every cent.